-

LEARN MOREThe Ultimate Support for

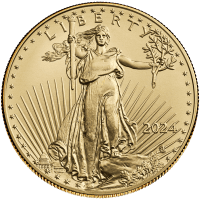

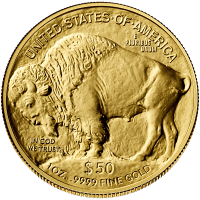

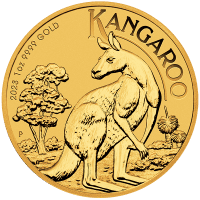

LEARN MOREThe Ultimate Support forPRECIOUS METALS

Serving dealers, financial institutions, banks and brokerage houses around theglobe for 45 years with industry-leading precious metals trading and refining services.

About Us

Dillon Gage Metals, centrally located in Dallas, Texas, has served precious metals dealers, financial institutions, banks and brokerage houses around the globe for 45 years with our finely-honed wholesale precious metals trading and refining services. We are authorized to purchase gold, silver, platinum, palladium and rhodium bullion coins directly from the world's major mints including the U.S. Mint and the Royal Canadian Mint...a distinction held by very few other companies.

Learn More

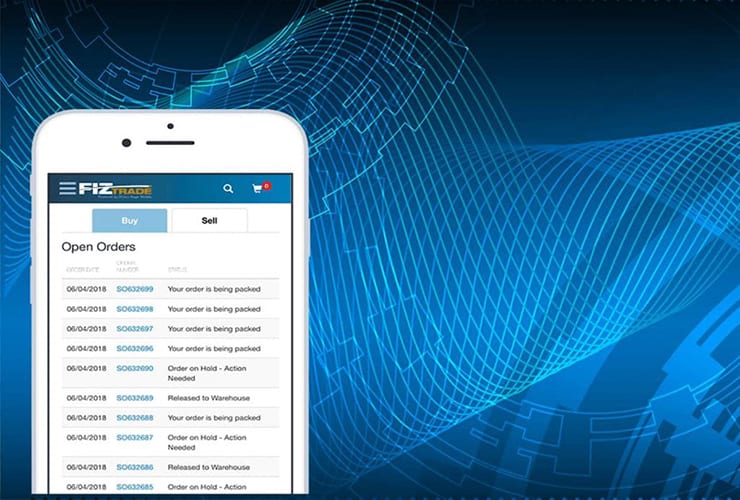

Fiztrade Online Trading

Dillon Gage developed one of the industry's first online platforms for real-time physical precious metals trading - FizTrade.com. It delivers Dillon Gage's global trading power right to your desktop browser or mobile device. Buy and sell hundreds of gold, silver, platinum and palladium products as well as access an array of propriety business management tools designed specifically for our clients' needs.

Learn MoreRefining

From purest karat gold to low-grade sweeps, Dillon Gage refinery delivers excellent returns on your melts with customer service that is second to none. Superior technology and expertise combine to process gold and silver as quickly as 24 hours, with no middleman, and simple fees disclosed upfront. We also process platinum group metals with speed and precision.

Additionally, our facility offers a clean, quick proprietary stone removal process that ensures you can make the most of your lots.

Precious Metals Storage

Experience secure and insured precious metals storage services through our three, dedicated depositories in North America. International Depository Services (IDS) Group is a wholly-owned subsidiary of Dillon Gage with facilities in Dallas, Texas, just outside Wilmington, Delaware, and our Canadian site in Ontario. All three locations provide a full array of custody and logistics services tailored to precious metals market participants with state-of-the-art security systems. IDS Group’s depositories serve institutional, individual investors, and IRA custodians nationally and abroad.

Learn More

Knowledge Center

- BLOG

-

Gold steady headed for fifth weekly gain

April 19, 2024 BLOGGold steady, little changed early Friday, headed for fifth weekly...

-

Gold Reclaiming ground on Middle East concerns

April 17, 2024 BLOGGold reclaiming ground this morning near record-highs on concerns that...

-

Gold pauses after Friday’s record-high

April 15, 2024 BLOGGold pauses after hitting Friday’s record-high as haven demand from...

-

Gold surges above $2,400 an ounce

April 12, 2024 BLOGGold surges to a new all-time high above $2,400 an...

- DG ALERTS

-

Dillon Gage Refinery Has Moved

September 20, 2023 DG ALERTSDillon Gage Refinery has moved to a larger facility and...

-

Weather Delays for February 1

February 1, 2023 DG ALERTSThe National Weather Service has issued an ice storm warning...

-

Thanksgiving Hours 2022

November 22, 2022 DG ALERTSThe Dillon Gage family wishes you and yours a very...

-

Memorial Weekend Hours for 2022

May 30, 2022 DG ALERTSDillon Gage trading room and refinery will be closed Monday,...

- FEATURED SERVICES

-

Quick Pay Now ON FizTrade

June 9, 2021 FEATURED SERVICESDillon Gage has incorporated ACH payment options on the award-winning...

-

FizTrade Mobile App Upgrades

December 2, 2019 FEATURED SERVICESThe FizTrade mobile app puts the power of Dillon Gage’s award-winning Physical Precious Metals Trading platform in the hands of iPhone users with 24-hour trading, up-to-the-minute order status updates, real-time bid/ask pricing and management of the fulfillment process.

-

IRAConnect ANA Demo

August 14, 2017 FEATURED SERVICESIRAConnect is demoed at the ANA’s World’s Fair of Money...

-

IRA CONNECT

April 24, 2017 FEATURED SERVICESDillon Gage is changing the way IRAs are facilitated with...

- PRECIOUS METALS INSIGHTS

-

2024 American Eagle YTD Sales

April 12, 2024 PRECIOUS METALS INSIGHTSHere are the 2024 American Eagle YTD sales totals for...

-

2023 American Eagle YTD Sales

December 29, 2023 PRECIOUS METALS INSIGHTSHere are the 2023 American Eagle YTD sales totals for...

-

2022 YTD American Eagle Sales

December 30, 2022 PRECIOUS METALS INSIGHTSThe following chart shows the first American Eagle YTD sales...

-

American Eagle 2021 Sales

December 17, 2021 PRECIOUS METALS INSIGHTSThe following chart includes the American Eagle YTD sales totals...

- PRESS ROOM

-

Dillon Gage Attains RJC Certification

October 31, 2023 PRESS ROOMDallas (October 31, 2023) Dillon Gage, the global leader in...

-

Sustainability and DG making news

November 7, 2022 PRESS ROOMDuring the recent Gold Summitt in Vienna, Terry Hanlon, President...

-

Dillon Gage Invests In The Planet With Sustainable Refinery Practices This Earth Day

April 21, 2022 PRESS ROOMLeading Precious Metals Wholesaler Paves The Way For A More...

-

Dillon Gage Joins Forces with Fairmined to Sell Responsibly Mined Gold

March 29, 2022 PRESS ROOMDillon Gage Refinery is one of select few U.S. Refineries...

- All Posts